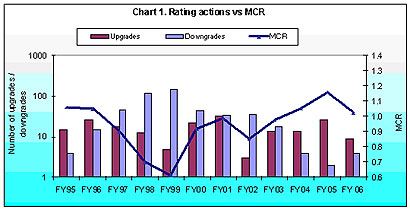

CRISIL Ratings expects Indian companies to face increasing credit quality pressure in the coming years. CRISIL's modified credit ratio (MCR, the ratio of upgrades plus reaffirmations to downgrades plus reaffirmations) has declined for the first time after rising continuously for three years: in FY06 (refers to the period April 1, 2005 to March 31, 2006), CRISIL's MCR declined sharply to 1.03, from an all-time high of 1.16 recorded for FY05.

This decline indicates a downward turn in creditworthiness in line with CRISIL's expectations. Given that CRISIL's rated portfolio covers key sectors of the Indian economy, and includes most of the top players in each segment, CRISIL's MCR stands out as a reliable indicator of systemic credit quality, and of underlying business fundamentals.

This trend is corroborated by the decline in IIP (Index of Industrial Production) after three years of increase, and the increase in real interest rates after three years of decline. The expectation is also reflected in the increase in the number of negative outlooks on CRISIL's outstanding ratings. However, the impact of this credit quality pressure will be gradual, given the strong financial position that rated Indian companies have built up over time.

MCR dips after a record high

CRISIL's modified credit ratio (MCR) is defined as the ratio of upgrades plus reaffirmations to downgrades plus reaffirmations. In FY06, CRISIL's annual MCR for long-term ratings declined sharply to 1.03, from the previous high of 1.16 recorded in FY05. The MCR for FY06 reflects nine upgrades and four downgrades in CRISIL's long-term ratings portfolio . This compares with 26 upgrades and two downgrades in the previous financial year. (Refer Appendix for CRISIL's upgrades and downgrades for long-term ratings in FY06).

The decline in CRISIL's MCR, for the first time in four years, clearly shows increased pressure on creditworthiness for Indian companies. This trend reversal is in line with CRISIL's expectation of stiffer challenges in the medium term for Indian companies on the credit quality front; this expectation was articulated in CRISIL's Ratings Round Up for the first half of FY06, published in October 2005. CRISIL expects companies to face greater challenges in maintaining or improving their credit profiles over the next few years, though their currently strong financial positions may mute the impact of the credit quality pressure to some extent over the short term.

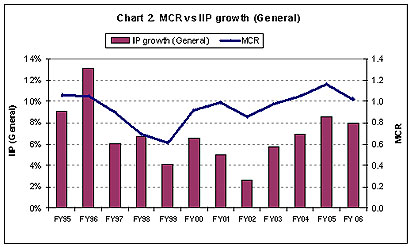

Strong correlation with IIP continues

CRISIL's MCR is a sensitive measure of industrial performance and the prospects of the Indian economy, as it covers a wide range of sectors and key players in each sector. This is reflected in the consistently high degree of correlation between CRISIL's MCR and India's Index of Industrial Production (IIP). In line with the declining MCR, the growth in IIP also declined to 8.0 per cent in FY06, from 8.5 per cent in FY05. IIP growth has declined after 3 years of continuous increase, similar to the CRISIL's MCR.

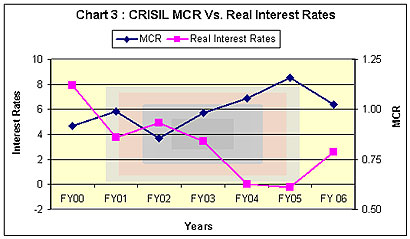

Increasing real interest rates further corroborates the trend reversal

The strongest signal for the trend reversal in credit quality arises from the high degree of inverse correlation observed between CRISIL's MCR and the real interest rates in India (Refer Chart 3:CRISIL MCR Vs. Real Interest Rates). This inverse correlation continued in FY06: after 3 years of continuous decline, real interest rates increased from -0.26 per cent in FY05 to 2.68 per cent in FY06 (CRISIL Centre for Economic Research estimates).

Real interest rates have a strong bearing on the global competitiveness of Indian companies, due to these companies' high and increasing integration with global markets. The currently high real interest rates are not expected to decline in the medium term, a fact that will have a negative impact on Indian companies' global competitiveness. This provides additional indications about the direction of CRISIL's MCR in the coming years, confirming the start of a downward turn in the creditworthiness cycle in India.

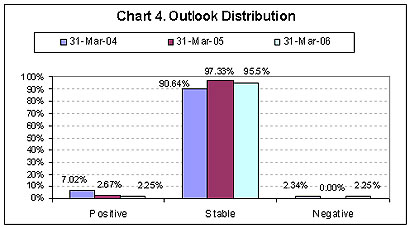

Higher proportion of negative outlooks adds to downward credit pressure

Rating Outlooks, assigned by CRISIL since September 2003, have proven their value as leading indicators of the likely direction of rating movements. Here again the trend has turned: as at the end of FY06, a little over 2 per cent of CRISIL's outstanding long-term ratings carried negative outlooks, compared to no negative outlooks in at the end of FY05 (Refer Chart 4: Outlook Distribution). Similarly, the proportion of positive outlooks has dropped from over 7 per cent of outstanding long-term ratings at the end of FY04, to about 2 per cent as of end-FY06. This corroborates CRISIL's view that the Indian companies are likely to face downward pressure on creditworthiness in coming years. However, with 95 per cent of ratings carrying stable outlooks, CRISIL does not expect the downward pressure to result in a significant weakening of credit profiles in the next 12-18 months.

Sectoral Analysis

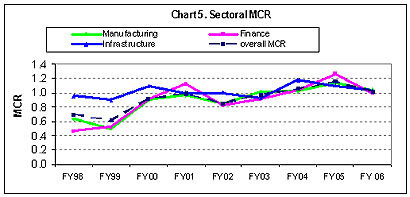

A sectoral analysis of rating actions indicates fairly similar MCR levels across sectors in FY06. The manufacturing sector continued to account for bulk of the rating actions (both upgrades and downgrades), followed by the infrastructure sector. The financial sector did not witness any upgrade or downgrade during year under review, and therefore recorded an MCR of 1.0 (Refer Chart 5: Sectoral MCR).

Manufacturing sector - Key monitorable is operating rates of new capacities

The manufacturing sector accounted for the bulk of rating actions: eight of the nine upgrades, and all four downgrades, occurred in this sector, resulting in a sectoral MCR of 1.04 as against 1.13 in FY05. Almost all the upgrades in the current year were on account of improved business fundamentals, resulting in better debt protection ratios, whereas the downgrades were caused by large debt-funded capital expenditure or acquisition, and strain on cash flows because of rising raw material costs.

Going forward, the upward momentum in interest rates, sustained high energy prices and the significant capacity building, which may lower the operating rates in many industries, are likely to be key constraints that the manufacturing sector faces. These factors are likely to intensify credit quality pressures over the medium term.

Financial sector- Parent/Government support to reinforce stability

CRISIL's ratings on financial sector entities displayed a high degree of stability in FY06. The MCR of 1.0 for FY06 compares with an MCR of 1.27 in FY05, a year in which a significant number of banks and bank subsidiaries were upgraded due to CRISIL's reassessment of the Government of India support available to public sector banks. The currently high credit quality of rated financial sector entities (over 95 per cent of financial sector ratings are in AAA or AA category) is primarily driven by the benefit of the support that most rated entities in the sector derive from Government or from strong foreign parents. In CRISIL's opinion, this lends a high degree stability to their overall credit risk profiles.

Infrastructure sector - oil prices hold the key

The infrastructure sector witnessed one upgrade and no downgrade during FY06, resulting in an MCR of 1.03 as against 1.10 in FY05. The upgrade in the current year - on Coal India Ltd - was driven by significant improvement in the company's financial risk profile, aided by high realisations for coal. Going forward, CRISIL expects this sector to witness some credit pressure due to high international oil prices, which may affect both oil as well as power sector.

Conclusion

CRISIL Ratings believes that the phenomenon of improving credit quality of Indian companies, witnessed in the last three years, is over; the cycle of creditworthiness has taken a downward turn, with likely credit quality pressures on Indian companies in the medium term. Strong signals for this conclusion emerge from the dip in CRISIL's MCR for the first time in last four years, the trend reversal in real interest rates, and a higher proportion of negative rating outlooks. CRISIL Ratings expects that, though the currently strong financial risk profile of Indian companies could provide some cushion in the short term, credit quality pressures and the resultant impact on credit risk profiles will be inevitable in the medium term.

| Appendix |

| CRISIL's Long-Term Rating Upgrades in FY06 |

| Sr.No | Company | Industry | Rating From | Outlook From | Rating To | Outlook To |

| 1 | Soma Textiles & Industries Limited | Textile - Cotton | BB | Stable | BB+ | Stable |

| 2 | Uttam Galva Steels Limited | Steel | BBB+ | Stable | A- | Stable |

| 3 | Gujarat Ambuja Cements Limited | Cement & Cement Products | AA+ | Stable | AAA | Stable |

| 4 | VST Industries Limited | Cigarettes | AA | Stable | AA+ | Stable |

| 5 | Indian Petrochemicals Corporation Limited | Petrochemicals | AA | Stable | AAA | Stable |

| 6 | Carborundum Universal Limited | Abrasives | AA | Positive | AA+ | Stable |

| 7 | Hindustan Copper Limited | Metals | D | - | C | - |

| 8 | Coal India Limited | Mining | AA | Stable | AAA | Stable |

| 9 | The Dhampur Sugar Mills Limited | Sugar | BB | $$ | BBB+ | Stable |

| CRISIL's Long-Term Rating Downgrades in FY06 |

| Sr.No | Company | Industry | Rating From | Outlook From | Rating To | Outlook To |

| 1 | Hero Cycles Limited | Cycle & Cycle Components | AA+ | Stable | AA | Stable |

| 2 | Indian Farmers Fertilizer Cooperative Limited | Fertilizers | AA+ | # | AA | Stable |

| 3 | Electrosteel Castings Limited | Steel and Steel Products | AA+ | Negative | AA | Negative |

| 4 | Finolex Industries Limited | Plastic & Plastic Products | AA+ | Stable | AA | Negative |

| CRISIL's Fixed Deposit Rating Upgrades in FY06 |

| Sr.No | Company | Industry | Rating From | Outlook From | Rating To | Outlook To |

| 1 | VST Industries Limited | Cigarettes | FAA+ | Stable | FAAA | Stable |

| 2 | Indian Petrochemicals Corporation Limited | Petrochemicals | FAA+ | Stable | FAAA | Stable |

| 3 | Kirloskar Oil Engines Limited | Engines - Diesel | FA+ | Stable | FAA | Stable |

| 4 | Jindal Saw Limited | Steel Products | FA | $$ | FA+ | Stable |

| 5 | Jindal Saw Limited | Steel Products | FA- | Stable | FA | Stable |

| 6 | Kirloskar Brothers Limited | Compressors & Pumps | FAA- | - | FAA | - |

| 7 | The Dhampur Sugar Mills Limited | Sugar | FB+ | $$ | FA | Stable |

| 8 | Purulator India Limited | Auto Ancillaries | FA | Positive | FA+ | Stable |

| | # - Rating Watch with Developing Implications |

| | $$ - Rating Watch with Positive Implications |