India's fintech sector faced a 63% funding decline in 2023

04 Jan 2024

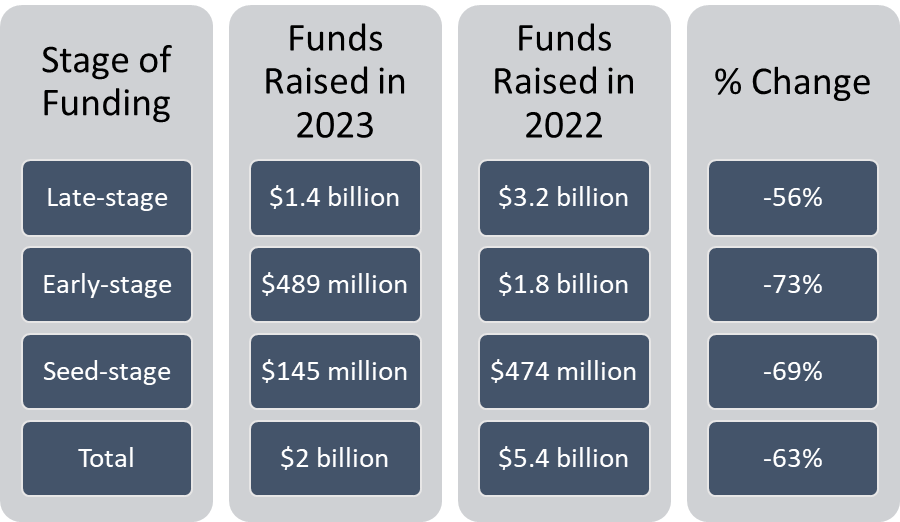

Amid the funding winter, India’s fintech sector experienced a significant setback, with a 63% decline in fund inflows throughout 2023, according to a report by Tracxn. The sector managed to secure a modest $2 billion in 2023, significantly lower than the $5.4 billion raised in 2022 and the $8.4 billion raised in 2021.

Despite this decline, India secured the third position globally in terms of fintech startup funding for 2023. Globally, startups are grappling with tightened funds due to escalating interest rates and challenging macroeconomic conditions.

Neha Singh, co-founder at Tracxn, emphasized that despite a 63% decline, the sector stood strong as the third-highest-funded ecosystem globally. She affirmed its position as a hub of innovation, mentioning that the implementation of regulatory measures and the government’s commitment to digitalization had set the stage for a promising future.

Neha Singh, the co-founder at Tracxn, emphasized that despite a 63% decline, the sector stood strong as the third-highest funded ecosystem globally. She affirmed its position as a hub of innovation, mentioning that the implementation of regulatory measures and the government's commitment to digitalization had set the stage for a promising future.

Key Highlights:

1) Limited Unicorns: The year witnessed only one unicorn, InCred, emerging in the fintech sector. However, consolidation was evident with 31 acquisitions, mirroring 2022.

2) Funding Rounds: Five funding rounds surpassed the $100 million mark, with Perfios leading in a Series D round with $229 million and Mintifi securing $110 million in a Series D funding round.

3) Public Offerings: Two companies, Zaggle and Veefin, announced initial public offerings in 2023, a notable decrease from the five companies that went public in 2022.

4) Consolidation and Acquisitions: TrillionLoans, Goals101, and Upwards were among the notable companies involved in acquisitions, emphasizing a rising trend towards consolidation.

5) Stage-wise Slowdown: A funding slowdown was observed across all stages of deals, with late-stage rounds witnessing a 56% drop, early-stage rounds falling sharply by 73%, and seed-stage rounds not immune to a 69% drop.

Bright Spots in Alternative Lending and BankingTech:

1) Alternative Lending: Despite the funding challenges, sectors within fintech such as alternative lending, payments, and bankingtech exhibited resilience. Alternative lending received $835 million in 2023, showcasing adaptability in a challenging environment.

2) BNPL Segment Growth: The ‘buy now, pay later’ or BNPL segment experienced significant growth, contributing to the overall sector. The adoption of BNPL within the country played a crucial role in its success.

3) BankingTech: Despite a funding decrease to $331 million in 2023, digitalization played a pivotal role in sustaining the BankingTech sector. The widespread adoption of digital banking, fueled by increased internet and mobile device penetration, contributed to its continued success.

Investors like Peak XV Partners, Y Combinator, LetsVenture, and others played crucial roles in shaping the sector’s dynamics. The report highlighted the potential growth facilitated by the Digital Personal Data Protection Act and the government’s allocation of $16.7 billion to the BharatNet project for rural broadband connectivity.

In summary, while facing a challenging funding landscape, India’s fintech sector remains resilient, driven by innovation, regulatory support, and digitalization initiatives, positioning itself for a promising future.