RBI MPC maintains 6.5% repo rate, raises FY24 GDP forecast to 7%

08 Dec 2023

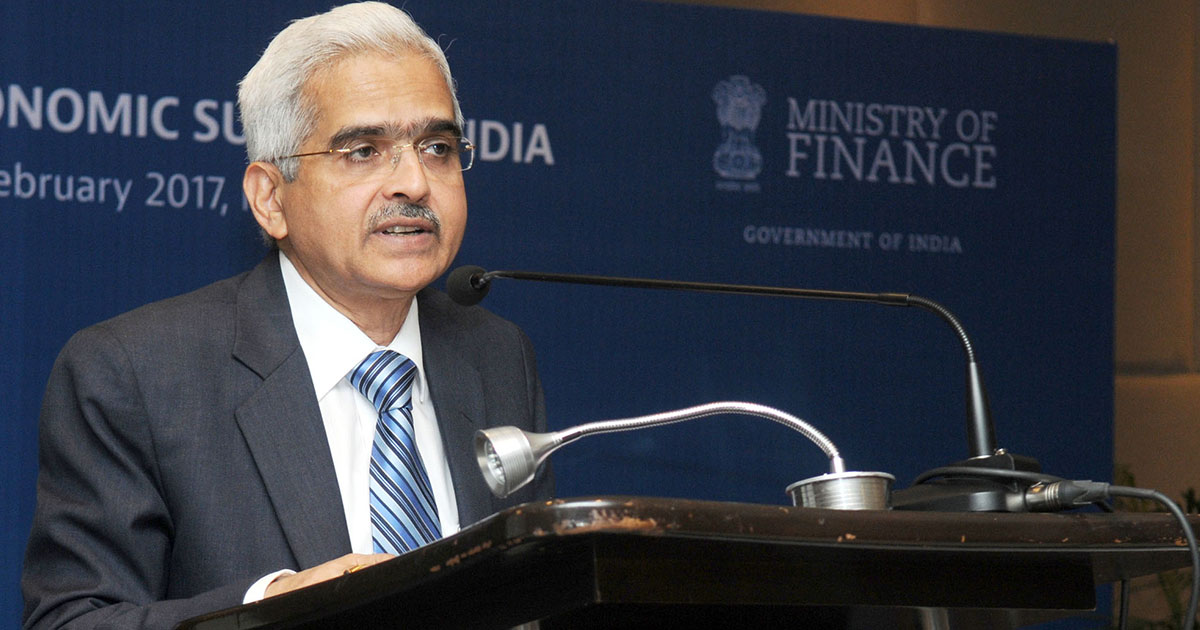

In its bi-annual policy announcement, the Reserve Bank of India’s Monetary Policy Committee (RBI MPC) opted to keep the repo rate unchanged at 6.5%, marking the fifth consecutive decision to maintain the status quo. RBI Governor Shaktikanta Das disclosed that the decision to keep the repo rate steady was unanimous among the committee members.

Governor Das further informed that, with a majority of 5-1, the RBI MPC has chosen to uphold the “withdrawal of accommodation” stance. However, he cautioned about the near-term forecast’s uncertainty, particularly regarding food inflation, which could potentially lead to an increase in headline inflation figures in November and December of the year 2023.

This decision follows a consistent trend, as the RBI MPC has held the repo rate steady since April. The committee had earlier implemented a series of rate hikes, totaling 250 basis points (bps) between May 2022 and February 2023, to curb escalating inflation. Notably, inflation dropped to a four-month low of 4.87% in October 2023.

Revised GDP projections and inflation forecasts

Governor Das also addressed the GDP forecasts for the financial year 2023–24, or FY24, announcing an upward revision to 7% from the previous 6.5%. Additionally, for the third quarter of the current financial year, or Q3 FY24, the GDP projection has been raised to 6.5% from the earlier estimate of 6%. The forecast for Q4 FY24 has similarly been revised upward to 6% from the previous 5.7%.

Looking ahead, the GDP projections for Q1 FY25 have been increased to 6.7% from 6.6%. Meanwhile, for Q2FY25 and Q3FY25, the GDP projections stand at 6.5% and 6.4%, respectively.

On the inflation front, the monetary policy committee opted to keep the projections unchanged. The retail inflation forecast for FY24 remains at 5.4%, with Q3 FY25 expected at 5.6% and Q4 FY24 at 5.2%. Looking into the next financial year, Q1 FY25 is projected at 5.2%, while Q2 FY25 and Q3 FY25 are anticipated to witness inflation at 4% and 4.7%, respectively.

As the RBI maintains a vigilant stance on economic indicators, these decisions aim to strike a balance between navigating the current economic landscape and ensuring stability in the face of evolving challenges.