RBI to launch Unified Lending Interface to smoothen credit flow

26 Aug 2024

Reserve Bank of India (RBI) is expanding the digital banking infrastructure with Unified Lending Interface (ULI), a platform that will facilitate frictionless credit flow.

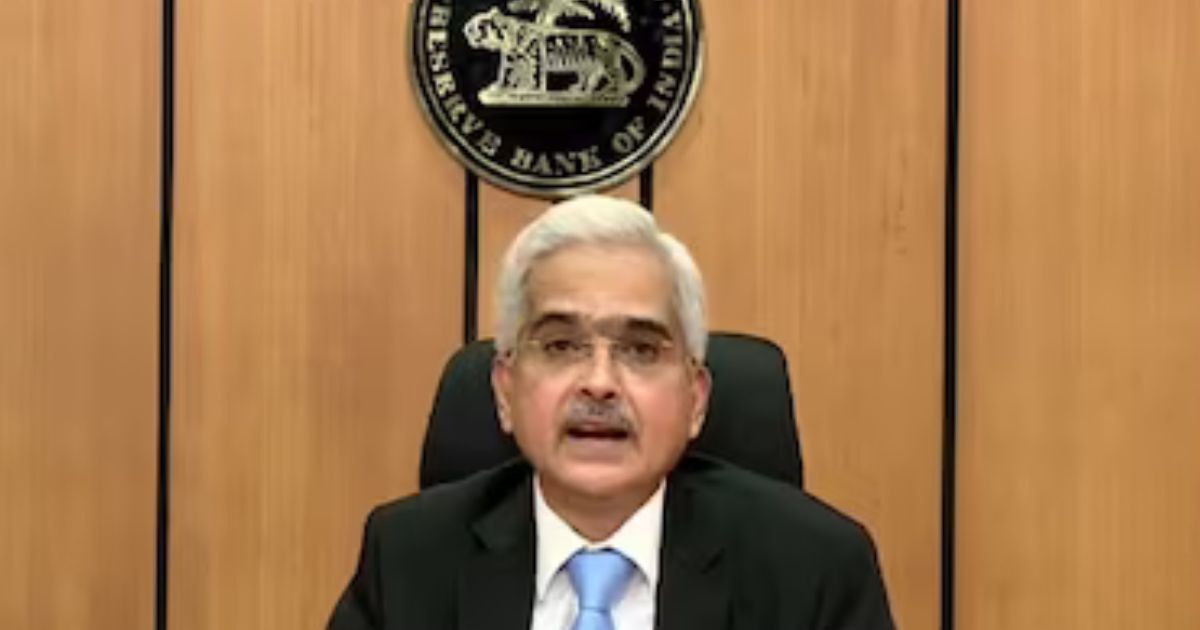

A natural extension of the Unified Payments Interface (UPI), the new mechanism will be launched nationwide soon, RBI governor Shaktikanta Das told an international conference on digital public infrastructure in Bengaluru on Sunday.

Das said the new technology will help reduce the time taken for appraisal in the case of small borrowers, especially in rural areas.

ULI has common and standardized APIs, designed for 'plug and play', which ensures digital access to information from diverse sources. This will facilitate seamless and consent based digital transactions, including exchange of information concerning land records of various states, he added.

By digitizing access to customer’s disparate financial and non-financial data, ULI is expected to cater to the demand for credit across various sectors, particularly for agricultural and MSME borrowers, Das pointed out.

Traditional banking system has undergone an unprecedented transformation with digital technologies, he said, adding that the process is likely to become even more intense in the coming years.

DPI spurs market innovation resulting in reduced transaction costs and driving competition, he added.