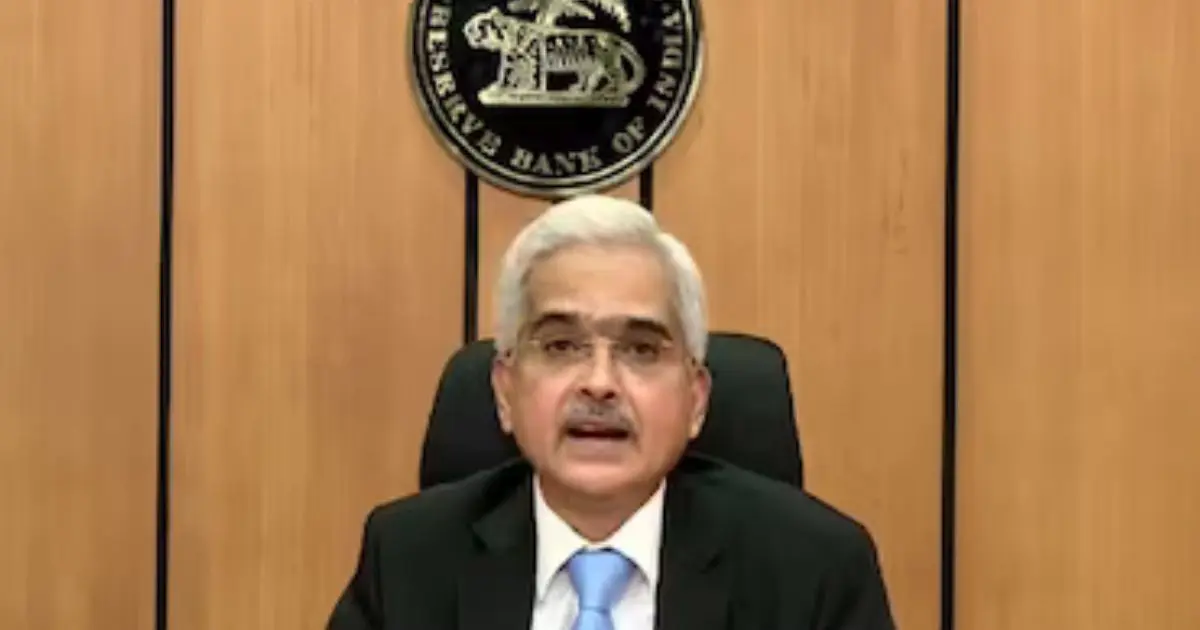

RBI keeps repo rate steady, cuts cash reserve ratio to 4%

06 Dec 2024

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) at its meeting on Friday (6 December 2024) decided to keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.50 per cent.

Accordingly, the standing deposit facility (SDF) rate will remain unchanged at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent, RBI stated in its monetary policy release.

However, RBI has announced a 50 basis point reduction in banks’ cash reserve ratio (CRR) from 4.50 per cent to 4.0 per cent in two tranches of 25 bps each over two fortnights beginning 14 December 2024.

RBI, in its Statement on Developmental and Regulatory Policies, said banks will be allowed to bring down their CRR from 4.50 per cent to 4.25 per cent beginning 14 December 2024 and from 4.25 per cent to 4.0 per cent from the fortnight beginning 28 December 2024.

Accordingly, banks are required to maintain the CRR at 4.25 per cent of their net demand and time liabilities (NDTL) beginning 14 December 2024.

RBI said the decision to maintain repo rate at 6.5 per cent has been taken in view of the current and evolving situation. The MPC also decided to continue with the neutral monetary policy stance and to remain focused on bringing inflation within the target rate, while supporting growth.

RBI has set the medium-term ceiling for consumer price inflation at 4 per cent within a +/- 2 per cent band.

As per RBI’s assessment, the global economy is on a stable growth path amidst slowing inflation. However, geopolitical risks and uncertainty on trade policies have brought volatility to global financial markets.

On the domestic front, real gross domestic product (GDP) grew at a slower than expected pace of 5.4 per cent in Q2 FY25 as private consumption and investment decelerated. Growth in gross value addition (GVA) during Q2 was aided by a resilient service sector and growth in agriculture, even as industrial activity continued to slow down.

Moving ahead, a bumper kharif foodgrain production and prospects of a good rabi and buoyancy in service sector augurs well for a pick-up in investment and industrial activity.

Improvement in overseas demand should provide support to external demand and exports. Hpwever, the risks of geo-political uncertainties, volatility in international commodity prices, and geo-economic fragmentation continue, RBI noted.

RBI expects India’s real GDP growth for 2024-25 to grow at 6.6 per cent with Q3 at 6.8 per cent and Q4 at 7.2 per cent.

Real GDP growth for Q1 2025-26 is projected at 6.9 per cent and Q2 at 7.3 per cent.

Headline CPI inflation has steadily climbed, reaching the upper tolerance level of 6.2 per cent in October from 5.5 per cent in September and sub-4.0 per cent prints in July-August. RBI expects food inflation to soften in Q4 with seasonal easing of vegetables prices and a good kharif harvest.

CPI inflation for 2024-25 is projected at 4.8 per cent with Q3 at 5.7 per cent and Q4 at 4.5 per cent.

CPI inflation for Q1 of 2025-26 is projected at 4.6 per cent and Q2 at 4.0 per cent.