Solar power to reach grid parity by FY17: Care Research

21 Jun 2012

The entry of new entrants into thermal power generation coupled with a slowdown in cola production and depletion at the KG basin reiterates a stronger focus on renewable energy, says a new report by Care Research.

Commercially, wind power generation is the cheapest source of power generation. However, with aggressive capital cost reduction in the last few years and high solar reception levels of between 300-320 days in a year makes solar energy a preferred choice for renewable capacity addition.

The Indian renewable energy industry, particularly the wind power segment is expected to slow down, primarily due to removal of the accelerated depreciation (AD) benefit removal from 1 April 2012. This is expected to lower the wind capacity addition from 3.2GW (1 GW = 1,000 MW) for FY12 to 2.2-2.4GW p.a. for the 12th Plan.

However, the solar capacity addition is expected to remain bright. The Jawaharlal Nehru National Solar Mission (JNNSM), a central scheme envisages addition of 20GW of grid-connected solar power capacity by 2022 (i.e. 13th Plan-end). This is to be achieved in the following three phases:

According to Revati Kasture, head, Care Research, '' In the last few years, the solar capital costs have primarily reduced on account of (1) cost reduction on account of capacity glut (global demand of 25 GW v/s capacity of 50GW) and (2) the entry of Chinese players into solar cell manufacturing has reduced solar capital costs. Resultantly, the solar capital costs have more than halved from Rs17 crore / MW in 2008 to Rs8-9 crore / MW now''.

However, going forward, Care does not expect the cost reduction to maintain the current pace as the 'balance of systems' (BoS), which accounts for 40 per cent of the system costs is increasing. Further, rising labour and land costs are also expected to cap the cost reduction going forward. Consequently, CARE Research expects the cost reductions to occur at 10-11 per cent y-o-y till FY17E (v/s 35-40 per cent yoy in the last few years).

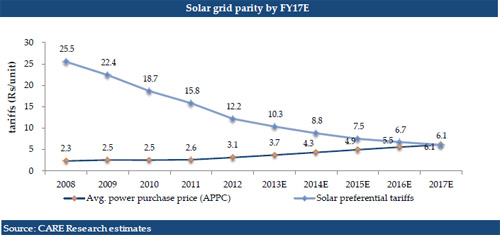

Care believes that solar power is expected to reach grid parity by 2017 (ie cost equivalent to average grid cost for conventional energy sources) primarily on account of (1) capital cost reduction of solar projects (2) increasing economies of scale and (3) improvement in rapidly maturing solar PV technology.

On the contrary, the conventional energy prices are expected to rise steeply owing to (1) increase in consumer tariffs by state distribution companies to align it with their average power purchase costs (2) Domestic coal shortage leading to higher imports, in turn implying rising power purchase costs for distribution companies and 3) Less possibility of substantial AT&C losses reduction to curb tariff hikes.

D R Dogra, MD and CEO, CARE Ltd, says, ''Solar PV projects capital costs have rapidly declined over the last few years; however, taking a cue, the central and state regulators too have aggressively reduced the preferential tariffs. In JNNSM Batch-II projects bidding, the power developers have bid aggressively for solar projects factoring falling capital costs.

"Resultantly, most of the banks / financial institutions (FI) are shying away from funding these projects as (1) there is not enough operating performance precedence for solar projects (as) solar irradiation data is unreliable in India and (2) aggressive bidding implying lower RoEs for the project developers''.

Financiers seem to prefer state based solar tariff-based projects as these projects offer comparatively higher preferential tariffs v/s JNNSM implying higher RoEs.