Sensex, Nifty, Bank indices at record close; Gruh Finance up 20%

19 Jan 2018

3:30 pm Market Closing: Benchmark indices as well as Bank Nifty ended at fresh record closing high.

The 30-share BSE Sensex was up 251.29 points or 0.71 percent at 35,511.58 and the 50-share NSE Nifty gained 77.70 points or 0.72 percent at 10,894.70.

All sectoral indices closed in the green.

3:25 pm ICICI Prudential Life up 4% post earnings: ICICI Prudential Life said profit in Q3 grew by 0.5 percent to Rs 452.1 crore against Rs 450 crore reported in year-ago.

Net premium income jumped 19.3 percent to Rs 6,795 crore from Rs 5,697 crore YoY.

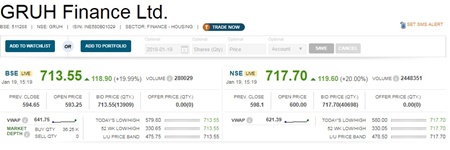

3:20 pm Gruh Finance at 20% upper circuit:

3:12 pm Market at record high: Benchmark indices as well as Nifty Bank touched another all-time high in late trade.

The 30-share BSE Sensex rallied 250.63 points or 0.71 percent to 35,510.92, and the 50-share NSE Nifty rose 72.80 points or 0.67 percent to 10,889.80.

Nifty Bank index jumped 355 points, following stable earnings from Kotak Mahindra Bank and HDFC Bank.

3:08 pm PC Jeweller Q3 Performance: PC Jeweller today reported 52 percent increase in its net profit at Rs 162.71 crore for quarter ended December on higher sales and profit margins.

The company, which has 84 retail jewellery stores across the country, had posted a net profit of Rs 106.97 crore in the year-ago period, the company said in a regulatory filing.

The total income (operating revenue plus other income) rose to Rs 2,690.42 crore in the third quarter of this fiscal from Rs 2,121.28 crore in the corresponding period of the previous year.

3:00 pm Results: Private sector lender IDFC Bank said its profit for the quarter ended December 2017 declined 23.6 percent to Rs 146.1 crore, compared to Rs 191.3 crore in year-ago. Profitability was hit by lower net interest income, other income and operating income; but was largely supported lower provisions.

Net interest income, the difference between interest earned and interest expended, fell 5 percent to Rs 495 crore compared to Rs 521 crore in year-ago.

Asset quality worsened during the quarter. Gross non-performing assets (NPAs) as a percentage of gross advances were sharply higher at 5.62 percent against 3.92 percent in previous quarter and net NPA was also higher at 3.52 percent in Q3 against 1.61 percent in Q2FY18.

2:55 pm Market Check: Benchmark indices extended gains in afternoon, with the Sensex rising 169.88 points to 35,430.17 and the 50-share NSE Nifty gaining 49.60 points at 10,866.60, driven by banks.

The Nifty Midcap index also gained half a percent but the market breadth was weak. About three shares declined for every two shares rising on the BSE.

2:50 pm New CFO for Jubilant Foodworks: Jubilant FoodWorks, which operates Dominos Pizza and Dunkin Donuts chains in India, today appointed Prakash C Bisht as the Chief Financial Officer (CFO) with immediate effect.

In his new role, Bisht will lead finance and accounts, secretarial and legal functions of the company, the firm said in a regulatory filing.

Bisht brings with him over three decades of experience in financial reporting, M&A transactions, fund raising and corporate structuring, among others.

He had earlier worked at Apollo Tyres for 15 years in various roles, the last being the leadership role as Head (Accounts), the company said.

2:43 pm Earnings: Kirloskar Oil Engines shares gained 3 percent after profit in Q3 increased 40.5 percent to Rs 39.5 crore from Rs 28.1 crore YoY.

Revenue from operations rose 6.8 percent to Rs 684.6 crore while operating profit grew by 10.7 percent to Rs 64.1 crore and margin expanded 40 basis points to 9.4 percent.

2:37 pm Oil Prices Fall: Oil prices fell on a bounce-back in US production, but ongoing declines in crude inventories curbed losses in the market.

Brent crude futures were at USD 68.72, down 54 cents, or 0.78 percent, from their last close. On Monday, they hit their highest since December, 2014 at USD 70.37 a barrel.

US West Texas Intermediate (WTI) crude futures were at USD 63.40 a barrel, down 55 cents, or 0.86 percent, from their last settlement. WTI marked a December-2014 peak of $64.89 a barrel on Tuesday.

2:15 pm Results: Jubilant Foodworks' Q3 earnings beat analyst expectations, with the profit rising sharply to Rs 66 crore from Rs 20 crore YoY and revenue growing 20.7 percent to Rs 795.2 crore.

Operating profit more than doubled to Rs 137 crore from Rs 64.04 crore and margin expanded sharply to 17.2 percent from 9.7 percent YoY.

The stock rallied 4.5 percent.

2:06 pm SEBI on REITs: To make REITs and InvITs more attractive, markets regulator Sebi has allowed strategic investors like registered NBFCs and international multilateral financial institutions to invest up to 25 percent of the total offer size of such trusts.

"The strategic investor(s) shall, either jointly or severally, invest not less than 5 per cent and not more than 25 percent of the total offer size," Securities and Exchange Board of India (Sebi) said in a circular.

The units subscribed by strategic investors, pursuant to the unit subscription agreement, will be locked-in for 180 days from the date of listing in the public issue.

2:00 pm Market Update: Benchmark indices continued to be volatile in afternoon, with the Nifty hovering in a tight range of 30-40 points on the higher side.

Banking stocks continued to support the market, with the Nifty Bank rising 240 points.

1:55 pm Earnings: NIIT Technologies reported Q3 profit at Rs 75.6 crore was ahead of CNBC-TV18 poll estimates of Rs 66.6 crore. The stock gained 3.5 percent.

Revenue from operations came in at Rs 756.5 crore was also ahead of estimates of Rs 741.3 crore while operating profit at Rs 125.3 crore for the quarter was also ahead of expectations of Rs 122.7 crore.

Operating profit margin at 16.6 percent was in line with estimates.

1:42 pm Drug Launch: Pharma major Lupin announced the launch of its Doxycycline Hyclate tablet USP, 100 mg having received an approval from the United States Food and Drug Administration (FDA) earlier.

Lupin's Doxycycline Hyclate tablet USP, 100 mg is the AB rated generic equivalent of Pfizer Inc.'s Vibra-Tabs, 100 mg.

It is indicated in the treatment of infections caused by various microorganisms and as an adjunctive therapy in severe acne.

Doxycycline Hyclate Tablet USP, 100 mg had annual sales of approximately USD 144 million in the US, as per IMS MAT November 2017.

1:36 pm Europe Trade: European markets opened mixed as investors watch out for developments in US politics, new earnings and fresh data.

The pan-European Stoxx 600 was 0.05 percent higher with sectors and major bourses moving in different directions.

In Asia, markets moved close to record higher despite losses on Wall Street overnight, over concerns of a likely government shutdown. There's uncertainty as to whether the US Senate will approve a bill to avoid the shutdown of the US government later on Friday.

1:32 pm Results Date: NTPC said a meeting of the board of directors of the company is scheduled to be held on January 31, 2018, to approve and take on record the unaudited financial results for the quarter and nine months period ended on December 31, 2017 and also to consider declaration of interim dividend for the financial year 2017-18.

1:21 pm ITC Q3 show: The diversified conglomerate, ITC reported 17 percent year-on-year (YoY) growth in net profit to Rs3090 crore was higher than CNBC-TV18 estimate of Rs2843 crore.

ITC reported a net profit of Rs2646 core in the corresponding quarter of last fiscal, the company said in a statement.

ITC rose 0.6 percent post Q3 results to Rs275.

Total revenues increased 5.7 percent on a YoY basis to Rs9772 crore for the quarter ended December compared to Rs9248 crore reported in the year-ago period.

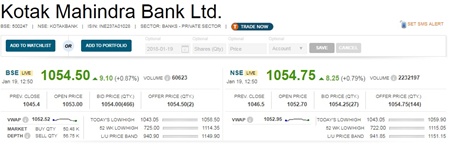

1:10 pm Results: Kotak Mahindra Bank reported steady set of numbers for December quarter, where the standalone net profit rose to Rs 1,053 crore against Rs 880 crore that it posted during the same quarter last year, a rise of around 20 percent.

The private sector lender's standalone net interest income (NII) rose to Rs 2,394 crore, up 17 percent from Rs 2,050 core during the corresponding quarter last year.

Meanwhile, the standalone net interest margin (NIM) came in at 4.2 percent.

On a consolidated basis, the bank's PAT increased to Rs 1,624 crore, up around 28 percent from Rs 1,267 crore. Meanwhile, the NII came in 16 percent higher at Rs 3,186 crore against Rs 2,747 crore year on year.

12:55 pm Kotak Mahindra Bank reacts to earnings:

12:50 pm Market Update: Benchmark indices were off day's high in afternoon, while the broader markets erased morning gains.

The 30-share BSE Sensex was up 80.04 points at 35,340.33 and the 50-share NSE Nifty rose 11.70 points to 10,828.70.

About two shares declined for every share rising on the BSE. Nifty Midcap index was down 0.2 percent.

Nifty Bank index continued to support the market, rising 150 points, driven by PNB, ICICI Bank, Canara Bank, SBI, Bank of Baroda, Kotak Mahindra Bank and HDFC Bank.

12:46 pm Rupee Trade: The rupee strengthened by 10 paise to 63.77 against American currency on good bouts of dollar selling by banks and exporters well supported by weak dollar overseas and bullish local equities.

The rupee opened sharply higher at 63.70 as against yesterday's closing level of 63.86 at the inter-bank foreign exchange here.

12:35 pm Steel Imports: The commerce ministry has allowed imports of non-standard steel products through Nhava Sheva, Mumbai and ICD-Tughlakabad in the national capital.

Earlier, import of these non-prime products called as seconds or defectives were not permitted through these ports.

"Imports of seconds/defectives of steel items...shall be allowed also through Nhava Sheva and at ICD-Tughlakabad, New Delhi, besides the existing customs sea port at Mumbai, Chennai and Kolkata," the Directorate General of Foreign Trade (DGFT) said in a notification.

The DGFT under the commerce ministry deals with export and import related matters.

12:25 pm Earnings Estimates: Wipro, which is scheduled to report its results for the quarter ended December 2017, might report 1 percent rise in dollar revenue to USD 2.03 billion, compared to USD 2.01 billion reported in the previous quarter.

The rupee revenue is likely to climb by 2.9 percent for the quarter ended December 2017 to Rs 13,553 crore, aided by acquisitions compared to Rs 13,169 crore reported in the previous quarter, according to CNBC-TV18 estimates.

The earnings before interest and tax is likely to fall slightly to 17.1 percent in Q3 compared to 17.3 percent reported in the previous quarter.

12:15 pm Poll: Diversified conglomerate ITC, which is scheduled to report results for the quarter ended December 31, could see a 7.5 percent rise in net profit to Rs 2,843 crore, compared to Rs 2,646.70 crore reported in the corresponding quarter last fiscal.

Analysts polled by CNBC-TV18 expect some weakness to continue for the salt-to-hotels conglomerate. The sentiment is largely weighed down by regulatory changes, particularly on the GST front, which have hurt cigarette volumes.

More than the results, the Street would be on the watch to see if there is an adverse tax imposition in the Budget to fuel fiscal slippage. The stock has underperformed the benchmark index by a wide margin.

The revenues (excise adjusted) are likely to grow by 9.1 percent on a year-on-year (YoY) basis to Rs 10,086 crore for the quarter ended December, compared to Rs 9,248 crore reported in the corresponding quarter of last fiscal, the poll revealed.

12:01 pm Earnings: Private sector lender HDFC Bank has reported profit growth of 20.1 percent for quarter ended December 2018, with slight increase in asset quality and strong loan growth.

Profit for the quarter stood at Rs 4,642.60 crore, up from Rs 3,865.33 crore in year-ago.

Net interest income during the quarter increased 24.1 percent to Rs 10,314.3 crore compared to Rs 8,309.09 crore in corresponding period, with strong loan growth of 27.5 percent.

11:51 am USFDA Approval: Cadila Healthcare shares rallied more than 3 percent after its Dabhasa API facility successfully completed the USFDA inspection.

"....announced today that the US Food and Drug Administration inspected its API manufacturing facility at Dabhasa (in Gujarat) from Janaury 15-19, 2018," the pharma company said in its filing.

At the end of inspection, no observation (483) is issued, it added.

11:45 am Earnings Expectations: Reliance Industries Ltd (RIL) is expected to report 3 percent quarter-on-quarter (Q0Q) rise in the standalone net profit to Rs8539 crore for the quarter ended December compared to Rs8265 crore reported in the previous quarter on Friday, according to CNBC-TV18 estimates.

The revenues are likely to grow by 15 percent to Rs78,913 crore for the quarter ended December 2017 compared to Rs68,532 crore reported in the previous quarter.

Analysts expect RIL's gross refining margins (GRMs) to come around $11.6 per barrel compared to $12 per barrel reported in the previous quarter. GRM is the difference between the per-barrel price of crude and the value of finished products distilled from it.

11:40 am Tata Steel's bonds issue: Tata Steel announced a successful dual tranche Reg S issuance of USD 1.3 billion of unsecured bonds in the international markets.

The issue comprises USD 300 million 4.45% unsecured bonds due on July 24, 2023 and USD 1 billion 5.45% unsecured bonds due on January 24, 2028 by Abja Investment Co Pte Ltd, a wholly owned subsidiary of Tata Steel incorporated in Singapore.

The bonds are rated BB- by S&P and will be listed on the Singapore Exchange (SGX).

11:33 am Acquisition: Drug firm Torrent Pharmaceuticals shares gained more than 1 percent intraday after it has acquired US-based generic pharmaceuticals and OTC firm Bio-Pharm Inc for an undisclosed amount.

To date, Bio-Pharm Inc has 10 approved abbreviated new drug applications (ANDAs) and 10 ANDAs under review at the United States Food and Drug Administration (USFDA) for itself and it's partners, Torrent Pharmaceuticals said in a filing.

The company also has an additional 17 products under development, it added.

11:24 am Buzzing: Shares of Adani Ports gained over 3.5 percent intraday as investors reacted positively to the December quarter performance.

The company reported a 19.51 percent jump in its consolidated profit at Rs 1,001 crore for the third quarter ended December 31, 2017. The logistics arm of Adani Group had clocked a consolidated profit of Rs 837.58 crore in the corresponding period last fiscal, it said in a BSE filing.

Brokerages were upbeat on the stock and believed that the stock was well placed for better moves ahead.

While maintaining Buy rating with target price of Rs 575, Citi said that the firm is one of our top picks in India infrastructure/logistics. Further, it said that the company reported well-rounded and strong third quarter earnings.

11:15 am Market Outlook: Even as the market soars to fresh records, midcaps have had a forgetful 2018 so far. Key midcap indices have corrected around 1-2 percent and stocks too have taken a beating in this space.

It does raise concerns on the momentum in midcaps and whether the party is now over.

Mahesh Patil, Co-Chief Investment Officer at Aditya Birla Sun Life AMC believes there could be some volatility going forward. ''Last year had very little volatility, but going forward there could be slightly higher volatile moves. The margin for error is less,'' Patil told CNBC-TV18 in an interview.

He feels largecaps could be in focus as this could be a year of higher flows by foreign institutional investors (FIIs). ''There is room for more FII money to come in this year. So largecaps could do better as their relative valuations are better too,'' he said. Patil expects FII flows to double this year.

11:05 am Buzzing: Jain Irrigation shares rallied more than 4 percent intraday after the GST rate on drip irrigation systems including laterals, sprinklers products has been reduced from 18 percent to 12 percent as per decision taken at 25th GST Council Meeting held on January 18, 2018. The new GST rates shall be effective from 25th January, 2018.

10:58 am Crude Oil Update: Crude oil futures slipped 1.54 percent to Rs 4,025 per barrel today, in line with a weak trend in Asian trade, as traders cut exposure at existing levels.

Crude oil for delivery in January was trading lower by Rs 63, or 1.54 percent, at Rs 4,025 per barrel, with a business volume of 4,637 lots at the Multi Commodity Exchange (MCX).

Also, oil prices for delivery in February fell Rs 62, or 1.52 percent, to trade at Rs 4,029 per barrel, with a business volume of 1,976 lots.

The US benchmark West Texas Intermediate fell 1.5 percent to USD 63.02, while Brent for was down 1.2 percent at USD 68.46 a barrel.

10:53 am Biocon Top Midcap Gainer:

10:50 am Market Update: Benchmark indices extended gains in morning, with the Nifty trading above 10,850 level, driven by banking and financial stocks.

The 30-sahre BSE Sensex was up 151.43 points at 35,411.72 and the 50-share NSE Nifty rose 36.70 points to 10,853.70.

About 1,375 shares advanced against 1,053 declining shares on the BSE.

10:41 am Acquisition: IT company Tech Mahindra announced it will acquire 17.5 percent stake in US-based telecom software development company Altiostar Networks for USD 15 million in a cash deal.

The investment committee of the board of directors of Tech Mahindra "has approved the proposal to acquire a shareholding in Altiostar Networks Inc, USA, through its wholly-owned subsidiary, that is, Tech Mahindra (Americas) Inc, USA," the company said in a regulatory filing.

Altiostar Networks is a US Corporation with presence across six countries in Europe, Asia Pacific and Latin American regions.

10:21 am Order Win: Dilip Buildcon has received letter of award from IRCON International for an EPC project valued at Rs 360.58 crore in the State of Karnataka.

The trading window for dealing in the securities of the company by its designated employees, directors and promoters shall be closed from January 19, 2018 to January 22, 2018 (both days inclusive), the company said.

10:15 am Earnings Estimates: Private sector lender Kotak Mahindra Bank's third quarter (October-December) standalone profit is seen rising 21 percent to Rs 1,064.2 crore, compared to Rs 879.8 crore in year-ago.

The Street is anticipating highest NII growth rate in last few quarters. Net interest income is expected to increase 19.4 percent to Rs 2,448.2 crore for quarter ended December 2017, compared to Rs 2,050.3 crore in same quarter last year, according to average of estimates of analysts polled by CNBC-TV18.

10:10 am Results Today: Reliance Industries, ITC, HDFC Bank, IDFC Bank, Kotak Mahindra Bank and Wipro will announce quarterly earnings.

10:04 am HCL Technologies' stock reaction post earnings:

9:56 am Market Update: Benchmark indices continued to trade with mild gains in morning, but the broader markets gained some strength after early volatility. Investors await corporate earnings and Union Budget.

The 30-share BSE Sensex was up 72.54 points at 35,332.83 and the 50-share NSE Nifty rose 7.30 points to 10,824.30.

Reliance Industries, HDFC, Adani Ports, ITC, SBI and L&T were leading contributors to Sensex' gains. The selling in Infosys, ICICI Bank and HDFC Bank capped gains.

The market breadth was balanced. About 1,135 shares declined against 1,036 advancing shares on the BSE.

9:46 am Rupee Trade: The rupee firmed up 19 paise to trade at 63.65 against the dollar in morning today, rising for a third straight day on increased selling of the US currency by exporters and banks.

Forex dealers said the dollar was weak against other currencies overseas which supported the rupee.

Yesterday, the rupee had gained 2 paise to close at 63.86 against the American currency.

9:40 am Earnings Estimates: Country's second largest private sector lender HDFC Bank is expected to report 20 percent growth in profit at Rs 4,626.3 crore for October-December quarter, compared to Rs 3,865.3 crore in year-ago.

The Street is anticipating the highest NII growth in last few quarters. According to average of estimates of analysts polled by CNBC-TV18, net interest income is seen rising 23 percent to Rs 10,226.6 crore from Rs 8,309.1 crore YoY.

9:34 am IPO Subscription: Amber Enterprises India's IPO has been subscribed 3.61 times, as per data available on the NSE website.

The public issue has received bids for 1.77 crore equity shares against IPO size of 49 lakh equity shares.

9:26 am Buzzing: Biocon shares gained 2 percent after the company and Sandoz, a division of Swiss-pharmaceutical major Novartis, said they have entered into a global partnership to develop, manufacture and commercialize multiple biosimilars in immunology and oncology for patients across the globe.

Under the terms of the agreement, both companies will share responsibility for end-to-end development, manufacturing and global regulatory approvals for a number of products and will have a cost and profit share arrangement globally.

Sandoz will lead commercialization in North America and the European Union, while Biocon will lead commercialization in the rest of the world.

9:19 am Earnings: IT firm HCL Technologies said its profit for October-December quarter increased 0.3 percent sequentially to Rs 2,194 crore and maintained full year constant currency revenue guidance.

Revenue during the quarter increased 3 percent quarter-on-quarter to Rs 12,808 crore and dollar revenue rose 3.1 percent to USD 1,988 million with constant currency growth at 3.3 percent, it added.

Numbers barring operational performance beat analyst expectations. Profit was estimated at Rs 2,135 crore on revenue of Rs 12,788 crore and dollar revenue at USD 1,978 million for the quarter, according to average of estimates of analysts polled by CNBC-TV18.

The software services provider has maintained its guidance for full year constant currency revenue at 10.5-12.5 percent and operating margin (EBIT) at 19.5-20.5 percent. Constant currency growth in dollar terms also maintained at 12.1-14.1 percent.

9:15 am Market Check: Equity benchmarks extended gains in opening on Friday, with the Nifty holding 10,800 level.

The 30-share BSE Sensex rose 65.36 points to 35,325.65 and the 50-share NSE Nifty gained 8.30 points at 10,825.30.

About 749 shares advanced against 637 declining shares on the BSE.

ITC, Kotak Mahindra Bank, HCL Technologies, HUL, Yes Bank, Adani Ports, Reliance Industries, Coal India and Eicher Motors were early gainers.

UltraTech Cement, Infosys, Bharti Airtel, Vedanta, Wipro, ICICI Bank and Tata Motors were early losers.

GVK Power, Jaypee Infratech, down 2-3 percent

Wonderla Holidays, Jain Irrigation, Gitanjali Gems and TBZ gained 2-6 percent post GST meet. Biocon rose 2 percent.