RBI keeps option for forex market intervention open

11 Oct 2010

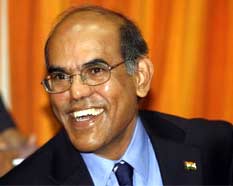

India reserves the right to intervene in the foreign exchange market if the inflows continue to be lumpy and volatile or if they disrupt the macroeconomic situation, Reserve Bank governor D Subbarao said today.

India reserves the right to intervene in the foreign exchange market if the inflows continue to be lumpy and volatile or if they disrupt the macroeconomic situation, Reserve Bank governor D Subbarao said today.

Our intervention will be to keep liquidity conditions consistent with activity in the real economy and to maintain financial stability, and not to stand against developments driven by changing economic fundamentals, he said.

Furthermore, in evaluating the level of reserves and the quantum of self insurance of a country, it is important to distinguish between countries whose reserves are a consequence of current account surpluses and countries with current account deficits whose reserves are a result of capital inflows in excess of their economy's absorptive capacity.

India's reserves comprise essentially borrowed resources, and the country is therefore more vulnerable to sudden stops and reversals as compared with countries with current account surpluses, he said.

Rao said forex inflows have swamped most emerging market economies (EMEs) over the past few months and several central banks have intervened in the forex markets. India, he said, has desisted from intervening to check the inflows as its absorption too has increased.

In fact, he said, portfolio inflows into India last month (September 2010) was the highest for any single month.