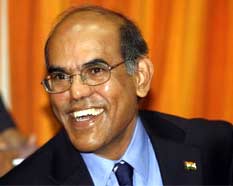

RBI leaves policy rates unchanged; hints at cuts

16 Dec 2011

The Reserve Bank of India, as expected, kept its benchmark interest rates unchanged in its monetary policy review today, after 13 successive hikes since March 2010.

The Reserve Bank of India, as expected, kept its benchmark interest rates unchanged in its monetary policy review today, after 13 successive hikes since March 2010.

Seeking to spur flagging industrial growth, the RBI even suggested that policy rates may be revised downward in the near future.

The central bank maintained the repo rate (at which banks borrow from RBI) at 8.5 per cent and the reverse repo rate (at which the RBI borrows from banks) at 7.5 per cent. It has also decided to retain the cash reserve ratio (CRR), the amount banks need to park with the RBI, at six per cent.

"While inflation remains on its projected trajectory, the downside risks to growth have clearly increased," RBI said in a statement along with the mid-quarter review of monetary policy.

"The guidance given in the second quarter was that, based on the projected inflation trajectory, further rate hikes might not be warranted. In view of the moderating growth momentum and higher risks to growth, this guidance is being reiterated," the statement said.

The central bank also said that from this point on, the effort would be to reverse the cycle of interest rate hikes.