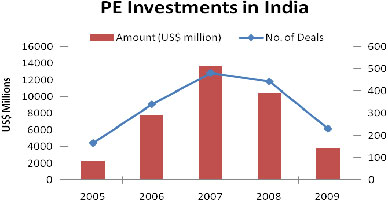

PE investments in India decline for second straight year to $4 billion

11 Jan 2010

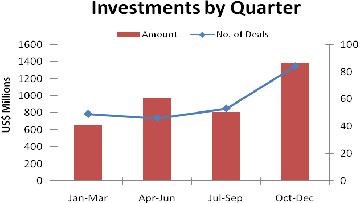

Chennai: Private Equity firms invested $1,392 million over 84 deals in India during Q4 2009, taking the annual investment numbers to $3,824 million over 232 deals, according to a study by PE and M&A research service Venture Intelligence.

These figures include venture capital investments, but do not include PE investments in real estate. The amount invested during 2009 was significantly lower than that during the previous year during which PE firms invested $10,468 million across 443 deals.

|

Source: Venture Intelligence

The amount invested during Q4'09 however was higher than that during the same period in 2008 (which witnessed $1,215 million invested across 72 deals) as well as the immediate previous quarter ($807 million across 53 deals).

|

| Source: Venture Intelligence |

''The volatility in the public markets and continued uncertainty around the ability to raise new funds caused investment activity to be muted in 2009,'' said Arun Natarajan, founder CEO of Venture Intelligence.

''With just six investments above $100 million in size in 2009 (compared to 22 such deals in 2008 and 27 in 2007), the year witnessed a clear decline in the appetite for large ticket investments,'' Natarajan noted.

The largest investment reported during 2009 was KKR increasing its stake in telecom software firm Aricent to 79% for a reported $255 million.

The Aricent investment was followed by the $180 million investment by existing investors IDFC PE and Oman Investments into independent tower infrastructure firm Quippo Telecom.

The third largest deal was Goldman Sachs' $115 million investment in publicly-listed healthcare firm Max India for a 9.4% stake.

| Top PE Investments* | |||

| Company | Sector | Amount (US$ M) | Investors |

| Aricent Quippo Telecom Max India Century Group Ind Barath Infra | IT Services (Telecom) Telecom Towers Hospitals Hotel Power Projects | 255 180 115 100 100 | KKR IDFC PE, Oman Investment Fund, Others Goldman Sachs Goldman Sachs Citi, Sequoia Capital India, Bessemer |

| Dish TV | DTH Services | 100 | Apollo Management |

| * By Reported Deal Size | Source: Venture Intelligence |

With 56 investments worth about $617 million, IT and IT-enabled Services (IT & ITeS) topped in terms of both value and volume during 2009, the study indicated. While BFSI came in next on the volume front with 32 deals, Energy was the second highest in value terms at almost $500 million.

Venture capital deals accounted for 37 per cent of the pie in volume terms in 2009. Late stage investments accounted for 28 per cent of the PE deals (in volume terms) and 38 per cent in value terms during 2009.

Companies based in south India lead both in terms of total number of investments as well as total value of transactions.

Whereas companies from western India rank second in terms of the number of investments, north-based companies received the second highest investments in term of value.

Among cities, Mumbai-based companies retained the top slot with 49 PE investments worth $850 million, closely followed by Bangalore with 42 investments worth $450 million and NCR with 36 investments worth about $1.08 billion. Hyderabad and Chennai attracted 25 and 22 investments each in 2009.

With 11 investments during the year, IFC was the most active PE investor in India during the year. IFC was active across a range of industries - including especially BFSI and Energy. Sequoia Capital India with 9 investments was the second most active investor during 2009, followed by StanChart PE and Aavishkaar with 8 investments each.