G-20's Washington summit: The old order changeth, yielding place to new

17 Nov 2008

World leaders from nearly two dozen countries, representing 80 per cent of the world's economy, wrapped up an emergency meet in Washington aimed at combating a snowballing global economic crisis. Contrary to widespread scepticism the meet has evolved a far-reaching action plan that, over the next four and a half months, will begin to reshape international financial institutions and reform worldwide regulatory and accounting rules.

World leaders from nearly two dozen countries, representing 80 per cent of the world's economy, wrapped up an emergency meet in Washington aimed at combating a snowballing global economic crisis. Contrary to widespread scepticism the meet has evolved a far-reaching action plan that, over the next four and a half months, will begin to reshape international financial institutions and reform worldwide regulatory and accounting rules.

Though originating in the United States, the crisis took on global dimensions, as money markets operate in a global environment, with scant or non-existing regulatory standards.

Broadly, the leaders agreed on broad principles with details to be worked out by committees in time for another summit meeting in April. The April meet will allow the incoming administration of US president-elect Barack Obama the traditional 100 days to settle down.

The next meet, very likely, will take place in London, as Britain chairs the G-20 for 2009.

In an impressive setting, the meet also managed to notch up some impressive agreements- though for now, only in principle.

After meeting over dinner at the White House on Friday the two dozen odd leaders continued their discussions on Saturday in a square in the central hall of the 19th-century National Building Museum, beneath a massive 159-foot high ceiling.

Hillary Clinton used the same setting for her end-of-the-campaign, "18 million cracks in the glass ceiling" speech.

In a global operational environment, there will now be a new regulatory body, "a college of supervisors," which will examine books of major cross-border financial institutions. This would allow regulators to gain a more complete picture of a bank's operations. Hedge funds will come under increasing scrutiny and a clearinghouse system will help to make transparent a number of opaque and very exotic financial derivatives –fancy transactions that contributed in no small measure to the collapse of legendary Wall Street investment banks.

In what is perhaps the most notable achievement, leaders also agreed to submit their countries' financial systems to regular reviews by the International Monetary Fund. Such reviews have long been resisted by a number of countries, including the United States.

Also, as a sign of the times, leaders have also agreed to take action on pay schemes at financial firms that "reward excessive short-term returns or risk-taking."

"We are determined to enhance our cooperation and work together to restore global growth and achieve needed reforms in the world's financial systems," the leaders declared in their communique.

A new global order

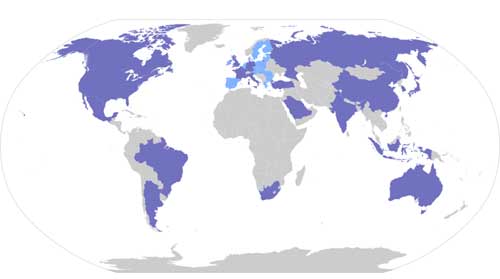

This gathering of nations, representing virtually every region of the world, also reflects the new balance of power now beginning to emerge from the financial crisis that has ushered almost all advanced economies of the world into a recessionary phase. Aptly, the British prime minister Gordon Brown has dubbed the crisis as "the birth pangs of this new global order."

With an avowed intention of reforming all Bretton Woods institutions, countries such as China, Brazil and India now stand to assume greater roles and responsibilities as the restructuring of these international financial institutions is accelerated. These nations had been clamouring for reforms for long without any response from European nations or the US.

Such reforms have been designated as a medium term objective by the G-20, which means that they will be attempted sooner rather than later, though not immediately. Any immediate reform may not even be possible, even if desired by India, Brazil and China.

Europeans, who have been urging a stricter regulatory regime in face of opposition from the US, succeeded in gaining commitments for new regulations and controls on banks, rating agencies and exotic financial securities.

That the era of free-wheeling capitalism may be drawing to a close, has now become evident with a public rebuke for the United States in the G-20 communiqué that a dramatic failure of market oversight in "some advanced countries" was among the root causes of the financial crisis.

"I'm a free market person," president Bush told reporters after the summit ended, "until you're told that if you don't take decisive measures then it's conceivable that our country could go into a depression greater than the Great Depression."

That admission would appear to end the argument for capitalism without controls. But senior Bush administration officials argued that the agreement yesterday did not signify a "pro-regulatory" shift by the administration but rather an acknowledgement that the regulatory system needed to be updated.

An important attendee, along with World Bank president Robert Zoellick, was Dominique Strauss-Kahn, managing director of the IMF. He called for nations to approve a fiscal stimulus equal to 2 per cent of gross domestic product, a move, he said, would result in a 2 per cent increase in growth.

The meet also recognised that developing countries would now need to be represented in elite financial institutions, and the communiqué called for the immediate expansion of the Financial Stability Forum to a "broader membership of emerging economies."

The Swiss-based organization has representation from finance ministry officials and central bankers, and thought it includes Singapore and Hong Kong, a notable absentee is China. According to reports, both Brazil and China laid claims for representation on the body.

The communiqué also said that, over time, the IMF and other global institutions "must be comprehensively reformed so that they can more adequately reflect changing economic weights in the world economy."

Traditionally, global economic crisis of such a nature would have been handled by the Group of Seven -- the United States, Britain, France, Germany, Japan, Canada, Italy and Russia, known as the G-8. But the situation has now changed dramatically.

"We are talking about the G-20 because the G-8 doesn't have any more reason to exist. In other words, the emerging economies have to be taken into consideration in today's globalized world," Brazilian president Luiz Inácio Lula da Silva said as he headed to the session.

At the meeting, Chinese president Hu Jintao called for "a new international financial order that is fair, just, inclusive and orderly." He, however, failed to address demands from Western countries that China use some of its $2 trillion in reserves to bolster the IMF.